DCF is an intrinsic form of valuation, which involves computing the magnitude of future expected cash flows and uncertainty regarding receiving those CFs (computed via DCF). This can be via Equity Valuation (FCFE) or Firm Valuations (FCFF)

DCF as a method is theoretically perfect as is not influenced by market movements. But, it needs a lot of assumptions leading to a higher degree of sensitivity – Garbage In Garbage Out.

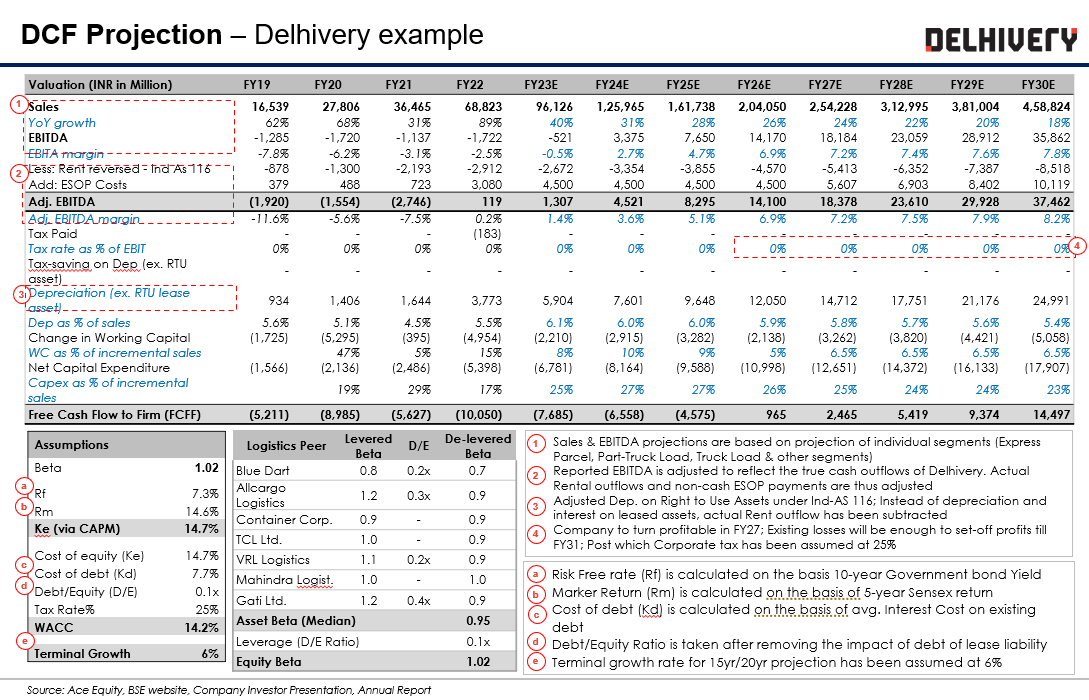

(1) Future Cash Flows

FCFF: Expresses the present value of the business attributable to all claimants (like equity shareholders, debt holders, preference shareholders etc.) as a function of its future cash-earning capacity. Cash flows are discounted using WACC

FCFE: Expresses the present value of the business attributable to equity shareholders as a function of its future cash-earning capacity. Cash flows are discounted using Ke.

Which method is preferred for DCF Valuations? FCFE model requires one to estimate the net borrowings of a firm. In the absence of a plan by the firm under consideration, estimating net borrowings is extremely subjective. In such a case, it is more prudent to use the based model to estimate the Enterprise Value first, and then arrive at Equity Value; Also, under FCFF we don’t need to worry about changing debt structure as FCFF does not consider debt cash flow. Thus, Usually, FCFF is preferred over FCFE. But FCFE is preferred for companies where D/E is stable, or Company has Nil debt;

Calculating FCFF and FCFE

(2) Weighted Avg Cost of Capital (WACC)

WACC or Kc means the opportunity cost of all capital invested in an entity. It is the rate a company needs to pay to its stakeholders (Debt and equity holders) and is computed by taking the market value weights of post-tax Kd and Ke.

The Capital Asset Pricing Model (CAPM) assumes that if an investor wants to earn a return without taking any risk he earns a return called as Rf. For higher risk, the return requirement increases

Sometimes practically, we don’t have enough time/data to calculate discount rates accurately, thus its better to take some approximate value and then perform a sensitivity analysis – the higher the risk higher the discount rates expected

Kc for a PE Fund is its Internal required rate of return – which is pre-defined; But for public companies, it’s the returns required by the stock market investors (IRR vs WACC)

The entire, WACC formula can get complicated as shown in the below diagram. Thus, we generally consider a broad 15-20% range as WACC depending on the risk profile of the company:

We have broken down and explained each element of WACC in a separate blog.

(3) Terminal Value

As per going concern, the value of a firm is the PV of infinite cash flows. But as cash flows cannot be accurately predicted after a specified forecast period (generally 5 to 10 years), the value of the firm after the forecast period is computed as Terminal Value

As a thumb rule, Terminal Value should not represent more than 50-60% of the firm’s value – because then the DCF is probably too dependent on future assumptions.

When is the Terminal Growth Method preferred over the Multiple Approach? If we have no good Comparable Companies or if have reason to believe that multiples will change significantly in the industry several years down the road. For example, if an industry is very cyclical you might be better off using long-term growth rates rather than exit multiples.

Terminal Growth Rate (g)

The terminal growth rate is the constant rate at which a company is expected to grow forever. This growth rate starts at the end of the last forecasted cash flow period in a discounted cash flow model and goes into perpetuity.

A company cannot grow at 15-20% forever, there’ll be stable returns - This stability is being derived from the rate at which the Indian economy is expected to grow.

Companies can’t grow at a rate higher than the rate at which the economy grows i.e. ~8% nominal growth rate for the next 3-4 decades. Thus, the maximum possible terminal growth rate will be the GDP of the economy i.e. 8%.

How do we calculate WACC and Ke in Real Life?

The existing academic formula for WACC & Ke is very complex. Investors in real life like to keep things simple.

Equity Investors generally take Ke = Risk Free Interest Rate + Extra for equity risk (4-8%)

But, also Ke reflects the investor’s expected IRR. So, if I want a long-term IRR of 25%, Ke for me will be 25%; WACC will then be derived from a weighted average of my Ke and Kd:

(4) Enterprise Value

Enterprise Value is the value of the company’s Core Business Operations (i.e. only the assets related to its core business), but to all the possible stakeholders (i.e. Equity, Debt & Preferred)

Equity Value is the value of everything the company owns (ALL its assets) but only to the Equity Investor

EV is very useful in comparing companies with different capital structures because a change in capital structure will not affect the amount of enterprise value. Hence, it is more commonly used in valuation techniques.

While computing EV, Cash/Investments/unused lands are excluded as these are non-operating assets and not relevant to the company's core operations.

Ideally, we should use market value for everything for calculating EV but in practice, we usually use market value only for the Equity Value portion, because it’s almost impossible to establish market values for the rest of the items in the formula

(Source: Ashwat Damodaran’s Blog)